Tax Law

Tax Law

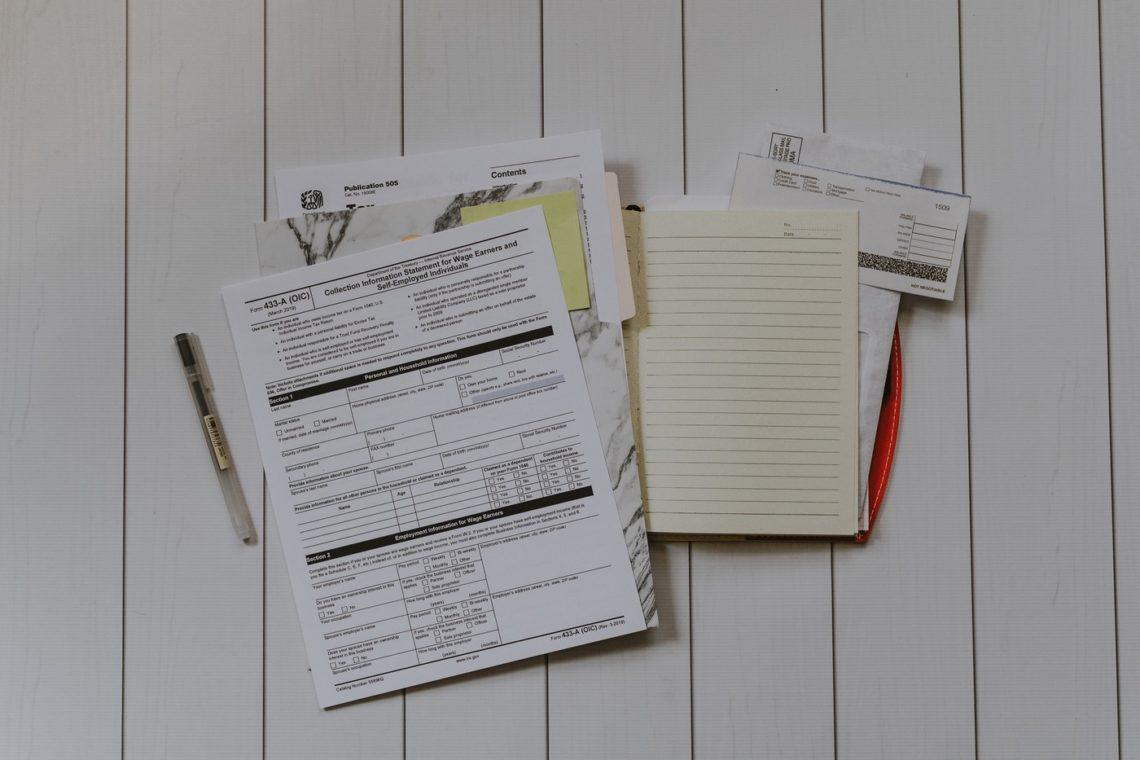

Taxes and Obligations

The tax area is engaged in acting in favor of its clients in legal relations between the State and private individuals and legal entities, concerning the imposition, bookkeeping, inspection and collection of taxes, fees and improvement contributions, tax surveillance, among others.

Our Office has a vast knowledge in tax law, acting in all instances, federal, state and municipal areas, comprising:

- Compliance to government inspections and regulations. Auditing;

- Tax planning;

- Reports;

- Administrative processes, judicial processes;

- Placement in special taxation schemes;

- Special conditions for payment of tax debts in installments;

- Corporate planning focused on tax pay reduction;

- Clearance of debts certificate in all instances;

- Tax credits, advantages, incentives;

- Compensations claims, tax refund and credit recovery;

- Regularization of foreign capital.

CPOM

Por anos, a Prefeitura de São Paulo exigia que prestadores de serviços de outros municípios realizassem o Cadastro de Empresas de…

Newsletter

Participate!